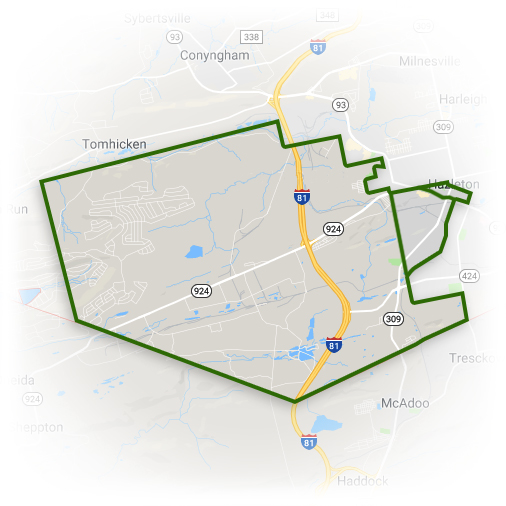

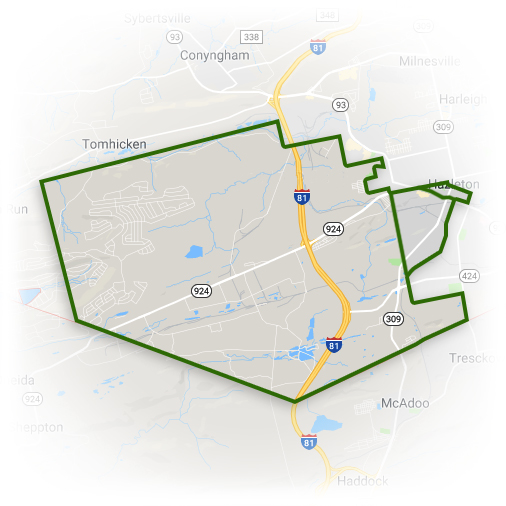

Portions of the Humboldt Industrial Park and Valmont Industrial Park received Federal Qualified Opportunity Zone (QOZ) designation from the Pennsylvania Department of Community and Economic Development. Investments made by individuals through special funds in these zones would be allowed to defer or eliminate federal taxes on capital gains.

Portions of the Humboldt Industrial Park and Valmont Industrial Park received Federal Qualified Opportunity Zone (QOZ) designation from the Pennsylvania Department of Community and Economic Development. Investments made by individuals through special funds in these zones would be allowed to defer or eliminate federal taxes on capital gains.

The passage of the Tax Cuts and Jobs Act in December of 2017 enabled Pennsylvania Governor Tom Wolf to designate certain tracts of land as Opportunity Zones based on economic data, recommendations from local partners and the likelihood of private-sector investment in those tracts.

Governor Wolf selected nearly all of Humboldt Industrial Park and portions of Valmont Industrial Park, as well as parts of downtown Hazleton, to be included in the Qualified Opportunity Zone and the designation received federal approval.

Consideration was given to population centers throughout Pennsylvania that have the potential for investment. Selection criteria also looked at whether future development in the tract would build on previous and ongoing public investments in infrastructure.

Private investment in Opportunity Zones can flow through Opportunity Funds. The program will allow U.S. investors to receive a temporary tax deferral and other tax benefits when they reinvest unrealized capital gains into Opportunity Funds for a minimum of five years.

For more information on the Federal Qualified Opportunity Zone program, visit the IRS Opportunity Zones Frequently Asked Questions page.